Starting February 2022, the Philippine Statistics Authority (PSA) released the rebased Consumer Price Index (CPI) for all income households to base year 2018, from base year 2012 as announced in the press release number 2022-01 dated 04 February 2022. The CPI series for all income households for February 2022 onwards will be 2018-based.

Table A. Year-on-Year Inflation Rates

for the Bottom 30% Income Households, All Items

In Percent

(2018=100)

Area | April | March | April | Year-to-date* |

2023 | 2024 | 2024 | ||

Philippines | 7.4 | 4.6 | 5.2 | 4.4 |

Central Visayas | 7.8 | 3.3 | 3.9 | 3.2 |

Bohol | 7.9 | 9.4 | 10.6 | 9.8 |

Cebu | 6.1 | -0.3 | -0.2 | -0.5 |

Negros Oriental | 16.4 | 4.4 | 5.0 | 4.0 |

Siquijor | 8.3 | 6.0 | 5.8 | 5.8 |

Cebu City | 2.3 | 4.2 | 5.2 | 4.5 |

Lapu-Lapu City | 2.7 | 8.7 | 9.3 | 7.5 |

Mandaue City | 3.9 | 9.7 | 10.1 | 9.2 |

Source: Philippine Statistics Authority

*Year-on-year change of CPI for March to April 2024 vs. 2023

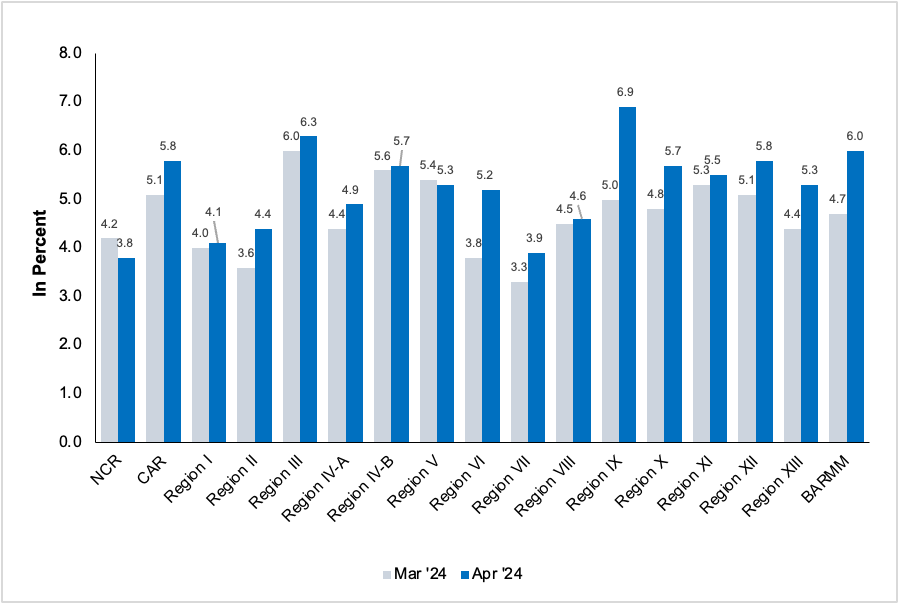

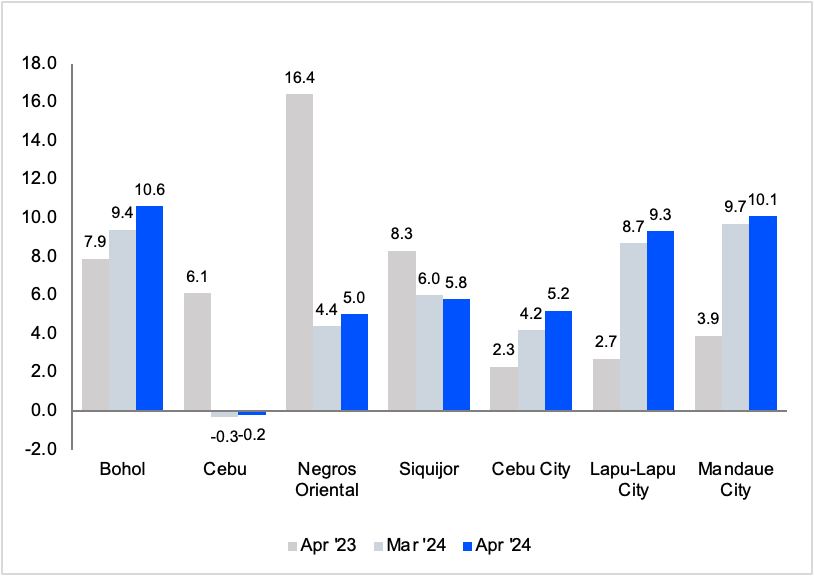

Figure 1. Inflation Rates for the Bottom 30% Income Households

by Region, All Items: March 2024 and April 2024

In Percent

(2018=100)

Source: Philippine Statistics Authority

A. The Philippines

The country’s inflation rate for the bottom 30% income households increased to 5.2 percent in April 2024 from 4.6 percent in March 2024. This brings the average inflation for this income group from January to April 2024 to 4.4 percent. In April 2023, inflation rate was posted at 7.4 percent. (Table A)

By Region

Among the 17 regions, 15 recorded faster inflation rates for the bottom 30% income households during the month and two regions recorded slower inflation rates relative to its March 2024 inflation rate. National Capital Region (NCR) recorded the lowest inflation rates at 3.8 percent while Region IX (Zamboanga Peninsula) recorded the highest inflation at 6.9 percent during the month. (Figure 1)

B. Central Visayas

1. B. Central Visayas

1. Regional Inflation

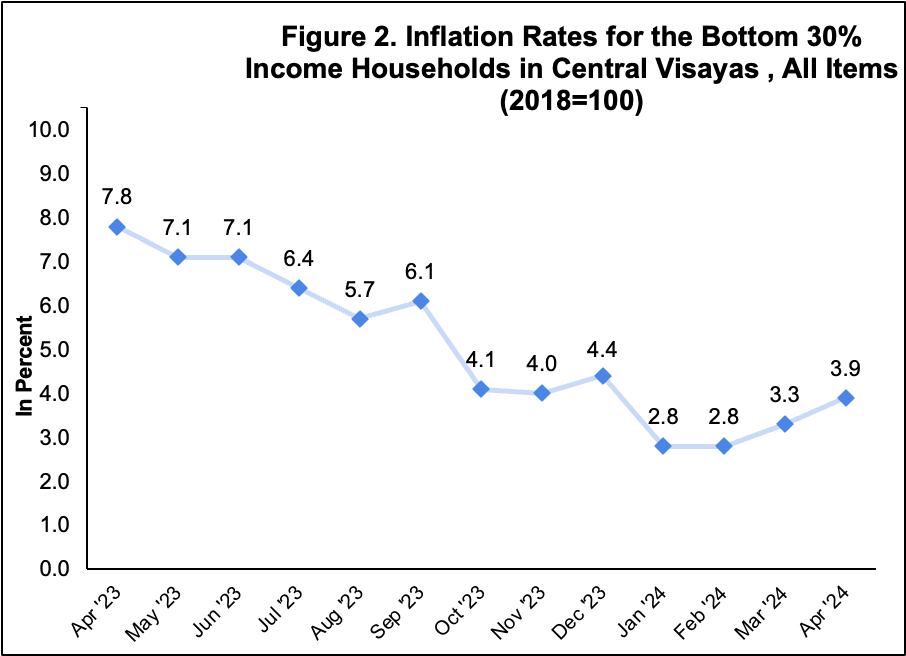

Inflation for the bottom 30% income households in Central Visayas further increased to 3.9 percent in April 2024 from 3.3 percent in March 2024. In April 2023, inflation rate was recorded at 7.8 percent. (Table A, B, and Figure 2)

1.1 Main Drivers to the Upward Trend of the Regional Inflation

The main driver of the upward trend of the overall inflation for this income group in April 2024 was the faster annual increase of the heavily-weighted food and non-alcoholic beverages at 3.8 percent from 2.6 percent in the previous month. The faster annual increment in the housing, water, electricity, gas and other fuels index at 6.3 percent during the month from a 4.9 percent annual increase in the previous month also contributed to the uptrend of the overall inflation for this income group. (Table 3)

In contrast, slower annual growth rates were noted in the indices of the following commodity groups during the month:

a. Alcoholic Beverages and Tobacco, 7.5 percent from 7.8 percent;

b. Clothing and Footwear, 2.0 percent from 2.3 percent;

c. Furnishings, Household Equipment and Routine Household Maintenance, 2.2 percent from 2.4 percent;

d. Health, 3.5 percent from 4.2 percent;

e. Transport, -4.3 percent from 1.1 percent;

f. Recreation, sport and culture, 5.7 percent from 5.8 percent; and

g. Personal Care, And Miscellaneous Goods and Services, 4.7 from 5.2 percent.

Meanwhile, the following commodity groups retained their previous month's rate:

a. Information and Communication at 0.0 percent;

b. Education Services at 1.0;

c. Restaurants and Accommodation Services at 4.9 percent; and

d. Financial Services, at -0.2 percent.

1.2 Main Contributors to the Regional Inflation

The following commodity groups were the top three contributors to the April 2024 overall inflation for the bottom 30% income households:

a. Food and Non-Alcoholic Beverages with 52.3 percent share or 2.0 percentage points;

b. Housing, Water, Electricity, Gas and Other Fuels with 28.6 percent share or 1.12 percentage points; and

c. Restaurants and Accommodation Services with 11.0 percent share or

0.4 percentage point.

2. Food Inflation

Food inflation for the bottom 30% income households at the regional level moved at a faster pace of 3.7 percent in April 2024 from 2.5 percent in the previous month. In April 2023, its annual increase was observed at 6.6 percent. (Table 7)

2.1 Main Drivers to the Upward Trend of Food Inflation

The uptrend in the food inflation was mainly due to the annual growth in vegetables, tubers, plantains, cooking bananas and pulses at 1.6 percent during the month from an annual drop of 10.5 percent in March 2024. In addition, faster year-on-year increases were also observed in the index of cereals and cereal products, which includes rice, corn, flour, bread and other bakery products, pasta products, and other cereals, at 6.9 percent in April 2024 from 6.2 percent in the previous month. The index of fish and other seafood also contributed to the higher food inflation with a slower annual decrease of 4.5 percent from 5.6 percent annual drop in March 2024.

(Table 5)

Moreover, slower annual decreases during the month were noted in the index of sugar, confectionery and desserts at 7.4 percent in April 2024 from 8.1 percent annual decline in March 2024.

In addition, faster annual increase was recorded in the indices of Ready-made food and other food products n.e.c. at 6.4 percent during the month from a 5.6 percent annual increase in March 2024, and fruits and nuts from an annual increase of 4.7 percent from 2.9 percent in the previous month.

In contrast, slower annual increases were recorded in the indices of the following food groups during the month: (Table 5)

a. Meat and other parts of slaughtered land animals, 7.9 percent from 9.7 percent; and

b. Milk, other dairy products and eggs, 6.4 percent from 8.8 percent.

Meanwhile, Oils and fats retained its previous month’s rate at 0.1 percent.

2.2 Main Contributors to the Food Inflation

Food inflation contributed 48.6 percent or 1.9 percentage points to the April 2024 overall inflation for this particular income group. Among the food groups, the main contributors to the food inflation during the month were the following:

a. Cereals and cereal products, which includes rice, corn, flour, bread and other bakery products, pasta products, and other cereals, with 79.9 percent share or 3.0 percentage points;

b. Meat and other parts of slaughtered land animals with 21.4 percent share or 0.8 percentage point; and

c. Milk, other dairy products and eggs with 10.1 percent share or 0.4 percentage point.

Table B. Year-on-Year Inflation Rates for Bottom 30% Income Households

in Central Visayas, All Items: January 2020 – April 2024

In Percent

(2018=100)

Month | Year | ||||

2020 | 2021 | 2022 | 2023 | 2024 | |

January | 1.2 | 1.2 | 8.0 | 10.0 | 2.8 |

February | 1.3 | 1.9 | 8.1 | 10.3 | 2.8 |

March | 1.1 | 2.0 | 7.9 | 9.8 | 3.3 |

April | 0.1 | 3.1 | 8.6 | 7.8 | 3.9 |

May | 0.7 | 2.7 | 8.6 | 7.1 | |

June | 3.1 | 1.1 | 8.9 | 7.1 | |

July | 3.2 | 0.7 | 10.5 | 6.4 | |

August | 2.4 | 1.9 | 10.7 | 5.7 | |

September | 2.0 | 2.4 | 11.7 | 6.1 | |

October | 2.4 | 2.7 | 13.0 | 4.1 | |

November | 2.4 | 3.7 | 12.7 | 4.0 | |

December | 2.4 | 2.8 | 13.2 | 4.4 | |

Average | 1.9 | 2.2 | 10.2 | 6.9 | 3.2 |

Source: Philippine Statistics Authority

C. By Province

Among the Provinces and Highly Urbanized Cities (HUCs) in Central Visayas, Province of Cebu recorded the lowest inflation in April 2024 at -0.2 percent while Bohol recorded the highest inflation during the month at 10.6 percent.

Moreover, two provinces and the three HUCs recorded faster year-on-year growth rates this month compared to the previous month’s inflation rates. Province of Cebu registered a slower annual decrease compared to its March 2024 inflation rate. (Table A, Figure 3)

Figure 3. Inflation Rates for Bottom 30% Income Households

by Province and Highly Urbanized Cities in Central Visayas,

All Items: April 2023, March 2024, and April 2024

In Percent

(2018=100)

Source: Philippine Statistics Authority

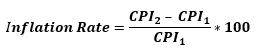

TECHNICAL NOTES

The Philippine Statistics Authority generates and announces the monthly Consumer Price Index (CPI) based on a nationwide survey of prices for a given basket of goods and services. Two important indicators, the inflation rate and purchasing power of the peso (PPP), are derived from the CPI which are important in monitoring price stability and the value of the country’s currency.

The CPI is an indicator of the change in the average retail prices of a fixed basket of goods and services commonly purchased by households relative to a base year.

Retail Price is the price at which a commodity is sold for spot in small quantities for consumption.

Base Period/Base Year is the period, usually a year, at which the index number is set to 100. It is the reference point of the index number series.

Market Basket is a term used to refer to a sample of goods and services that are commonly purchased and bought by an average Filipino household.

Weight is a value attached to a commodity or ground of commodities to indicate the relative importance of that commodity or group of commodities in the market basket.

Inflation Rate is equivalent to a decline in the purchasing power of the peso. It is the change in the CPI over a specific period of time (usually a month or a year). That is,

where:

CPI1 - is the CPI in the previous period

CPI2 - is the CPI in the current period

The Purchasing Power of the Peso (PPP) is a measure of the real value of the peso in a given period relative to a chosen reference period. It is computed by getting the reciprocal of the CPI and multiplying the result by 100. That is,

![]()

Headline Inflation is the rate of change in the weighted average prices of all goods and services in the CPI basket.

Approved by:

(SGD.) ARIEL E. FLORENDO

Regional Director