Starting February 2022, the Philippine Statistics Authority (PSA) released the rebased Consumer Price Index (CPI) for all income households to base year 2018, from base year 2012 as announced in the press release number 2022-01 dated 04 July 2022. The CPI series for all income households for January 2022 onwards will be 2018-based.

A. The Philippines

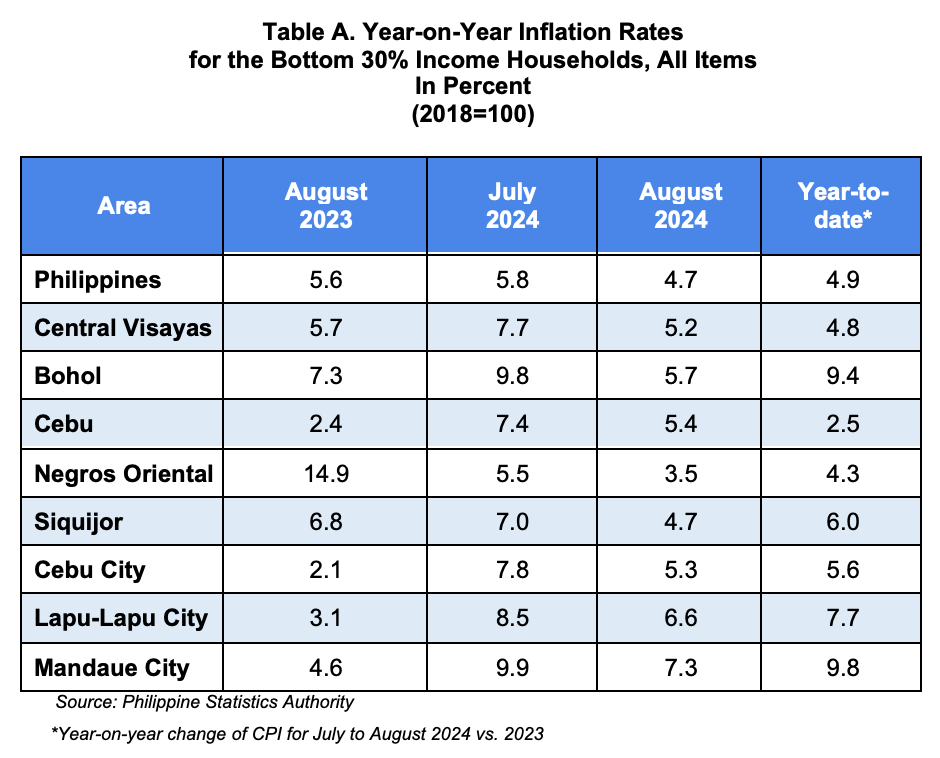

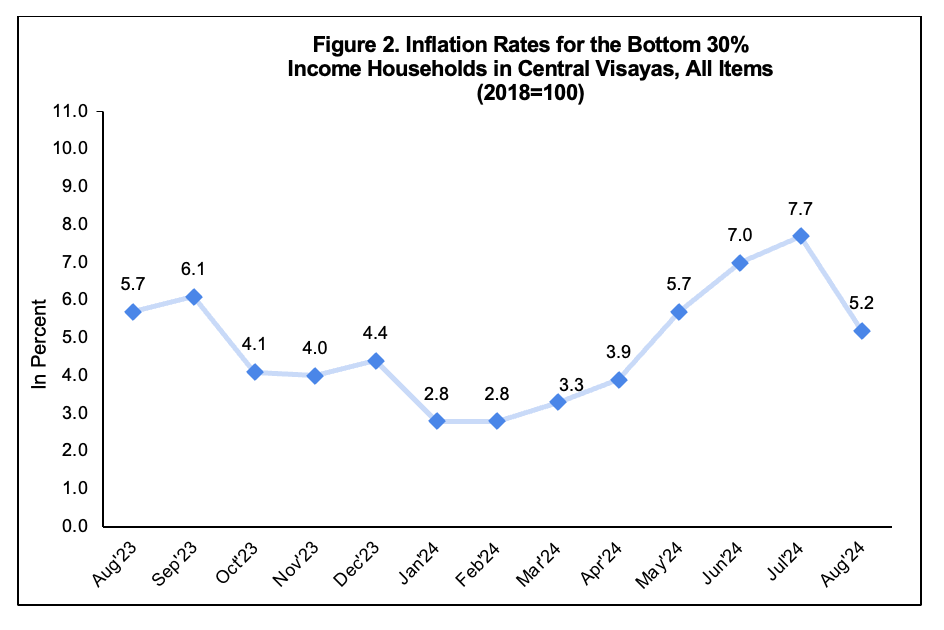

The country’s inflation rate for the bottom 30% income households slowed down to 4.7 percent in August 2024 from 5.8 percent in July 2024. This brings the average inflation from January to August 2024 for this income group to 4.9 percent. In August 2023, the inflation rate was posted at 5.6 percent. (Table A)

By Region

Among the 17 regions, two regions recorded faster inflation rates for the bottom 30% income households during the month and 15 regions recorded slower inflation rates relative to their July 2024 inflation rates. Region I (Ilocos Region) recorded the lowest inflation rate at 2.6 percent while Region XI (Davao Region) recorded the highest inflation at 6.3 percent during the month. (Figure 1)

B. Central Visayas

1. Regional Inflation

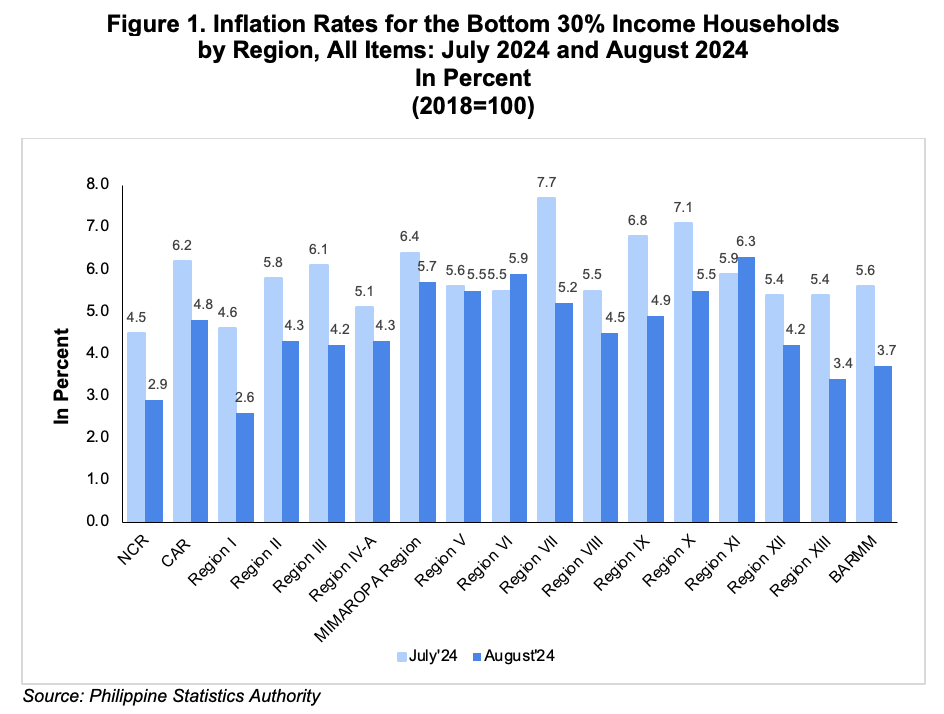

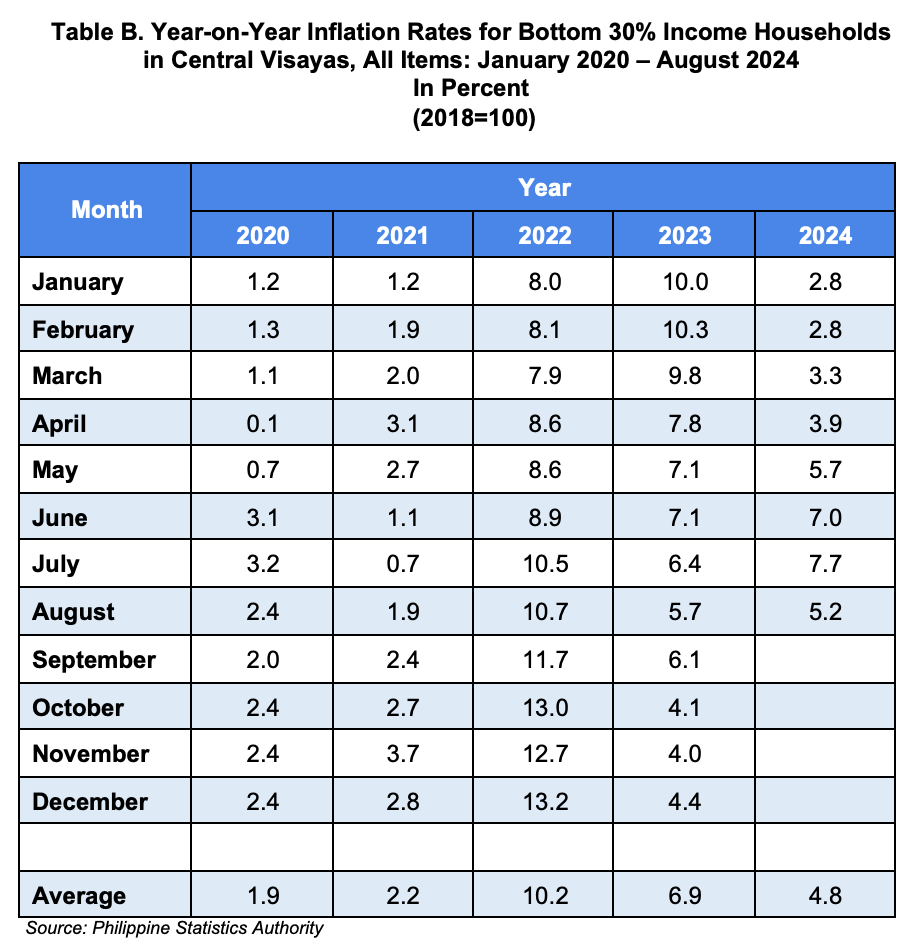

Inflation for the bottom 30% income households in Central Visayas slowed down to 5.2 percent in August 2024 from 7.7 percent in July 2024. This brings the average inflation for this income group from January to August 2024 to 4.8 percent. In August 2023, inflation rate was recorded at 5.7 percent. (Table A, B, and Figure 1)

1.1 Main Drivers to the Downward Trend of the Regional Inflation

The downtrend in overall inflation for the bottom 30% income households in August 2024 was primarily driven by the slower year-on-year increase in the heavily weighted food and non-alcoholic beverages index, which dropped to 7.3 percent in August 2024 from 10.3 percent in the previous month. Additionally, the transport index recorded an annual decline of 8.2 percent during the month, compared to a 1.1 percent year-on-year increase in July 2024. The slower annual increment in the housing, water, electricity, gas, and other fuels index, which decreased to 6.8 percent in August 2024 from 7.6 percent in July 2024, also contributed to the overall inflation downtrend in August 2024.

Moreover, slower annual increases were noted in the indices of the following commodity groups during the month:

a. Clothing and Footwear, 1.6 percent from 1.8 percent;

b. Furnishings, Household Equipment and Routine Household Maintenance, 1.9 percent from 2.1 percent;

c. Health, 3.2 percent from 3.5 percent;

d. Restaurants and Accommodation Services, 3.3 percent from 3.8 percent; and

e. Personal Care, and Miscellaneous Goods and Services, 2.9 percent from 3.1 percent.

In contrast, faster annual increases were noted in the indices of the following commodity groups during the month:

a. Recreation, Sport and Culture, 6.0 percent from 5.8 percent; and

b. Education Services, 9.2 percent from 2.8 percent.

Meanwhile, the following commodity groups retained their previous month's rate:

a. Alcoholic Beverages and Tobacco at 3.8 percent;

b. Information and Communication at 0.0 percent; and

c. Financial Services, at -0.2 percent.

1.2 Main Contributors to the Regional Inflation

The following commodity groups were the top three contributors to the August 2024 overall inflation for the bottom 30% income households:

a. Food and Non-Alcoholic Beverages with 73.5 percent share or 3.8 percentage points;

b. Housing, Water, Electricity, Gas and Other Fuels, with 22.6 percent share or 1.2 percentage points; and

c. Restaurants and Accommodation Services with 5.4 percent share or 0.3 percentage point.

2. Food Inflation

Food inflation for the bottom 30% income households at the regional level moved at a slower pace of 7.6 percent in August 2024 from 10.9 percent in the previous month. In August 2023, its annual increase was observed at 2.9 percent. (Table 7)

2.1 Main Drivers to the Downward Trend of Food Inflation

The deceleration of food inflation was mainly due to the slower annual increment in rice index at 12.1 percent during the month from 20.1 percent in July 2024. Also contributing to the downtrend is fish and other seafood with an annual decrease of 7.2 percent during the month from 3.2 percent annual decrease in July 2024. Vegetables, tubers, plantains, cooking bananas and pulses index was the third contributor to the decrease in the food inflation for the bottom 30% income households with an inflation rate of 6.3 percent in August 2024 from 12.6 percent in July 2024.

Moreover, slower year-on-year increases during the month were noted in the following food groups:

a. Flour, bread and other bakery products, pasta products, and other cereals, 3.5 percent from 3.9 percent;

b. Meat and other parts of slaughtered land animals, 6.5 percent from 8.8 percent; and

c. Ready-made food and other food products n.e.c., 5.7 percent from 6.6 percent.

In contrast, the following food groups registered faster annual increments during the month:

a. Corn, 29.7 percent from 27.0 percent;

b. Milk, other dairy products and eggs, 3.4 percent from 1.6 percent; and

c. Fruits and nuts, 7.9 percent from 6.6 percent.

A slower annual decline was observed in the index of sugar, confectionery and desserts, with a decrease of 7.5 percent in August 2024 compared to a 7.9 percent year-on-year drop in July 2024.

Meanwhile, oils and fats retained their previous month's rate at 0.6 percent.

d.

2.2 Main Contributors to the Food Inflation

Food inflation contributed 72.0 percent or 3.7 percentage points to the August 2024 overall inflation for this particular income group. Among the food groups, the main contributors to the food inflation during the month were the following:

a. Cereals and cereal products, which includes rice, corn, flour, bread and other bakery products, pasta products, and other cereals, with 94.9 percent share

or 7.2 percentage points;

b. Meat and other parts of slaughtered land animals with 8.8 percent share

or 0.7 percentage point; and

c. Vegetables, tubers, plantains, cooking bananas and pulses with 5.3 percent share or 0.4 percentage point.

C. By Province

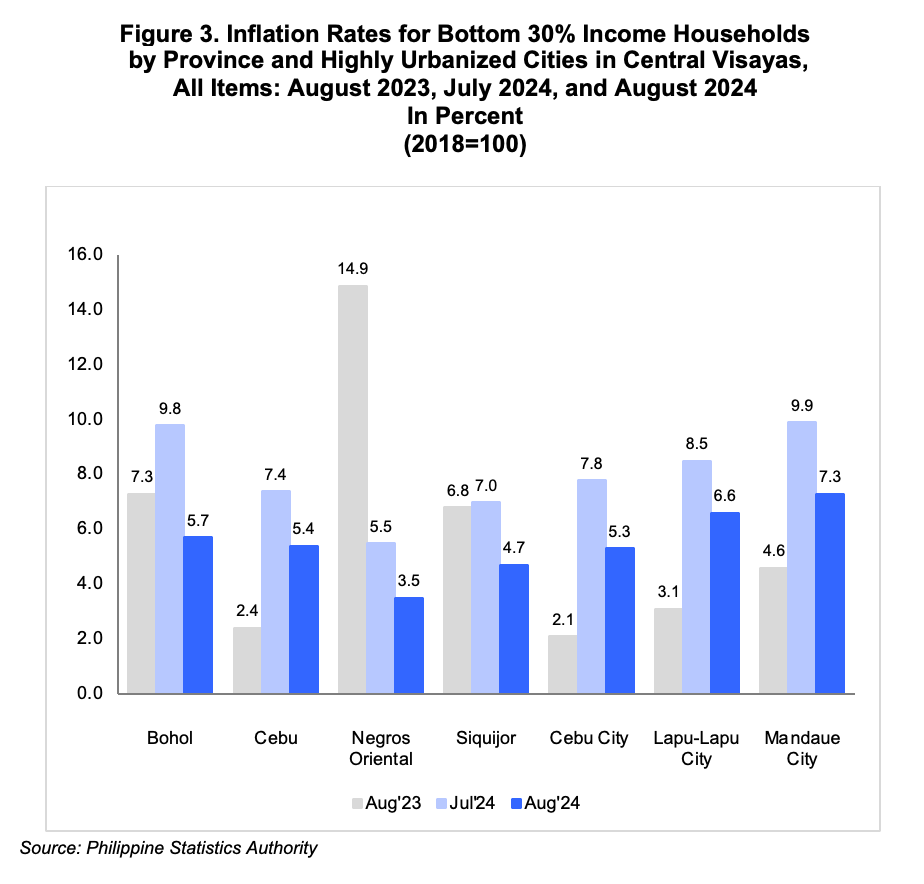

Among the provinces and Highly Urbanized Cities (HUCs) of Central Visayas, all provinces and HUCs recorded slower year-on-year increments this month compared to the previous month’s inflation rates. (Table A, Figure 3)

TECHNICAL NOTES

The Philippine Statistics Authority generates and announces the monthly Consumer Price Index (CPI) based on a nationwide survey of prices for a given basket of goods and services. Two important indicators, the inflation rate and purchasing power of the peso (PPP), are derived from the CPI which are important in monitoring price stability and the value of the country’s currency.

The CPI is an indicator of the change in the average retail prices of a fixed basket of goods and services commonly purchased by households relative to a base year.

Retail Price is the price at which a commodity is sold for spot in small quantities for consumption.

Base Period/Base Year is the period, usually a year, at which the index number is set to 100. It is the reference point of the index number series.

Market Basket is a term used to refer to a sample of goods and services that are commonly purchased and bought by an average Filipino household.

Weight is a value attached to a commodity or ground of commodities to indicate the relative importance of that commodity or group of commodities in the market basket.

Inflation Rate is equivalent to a decline in the purchasing power of the peso. It is the change in the CPI over a specific period of time (usually a month or a year). That is,

Inflation Rate=(CPI2 – CPI1)/CPI1 *100

where:

CPI1 - is the CPI in the previous period

CPI2 - is the CPI in the current period

The Purchasing Power of the Peso (PPP) is a measure of the real value of the peso in a given period relative to a chosen reference period. It is computed by getting the reciprocal of the CPI and multiplying the result by 100. That is,

PPP= 1/CPI*100

Headline Inflation is the rate of change in the weighted average prices of all goods and services in the CPI basket.

Approved by:

(SGD.)

ARIEL E. FLORENDO

Regional Director