A. Philippines

Inflation rate for the bottom 30% income households in the Philippines increased to 3.4 percent in October 2024 from 2.5 percent in September 2024. This brings the year-to-date inflation of the country at 4.5 percent. In October 2023, inflation rate posted at 5.3 percent. (Table A)

The maid driver to the upward trend of inflation for this income group is the higher year-on-year growth rate of food and non-alcoholic beverages to 3.9 percent in October 2024 from 2.1 percent in September 2024.

B. Central Visayas

Similar to the national level, Central Visayas inflation rate for the bottom 30% income households increased to 3.6 percent in October 2024 from 1.8 percent in September 2024 bringing the year-to-date inflation at 4.4 percent. In October 2023, inflation rate in this income group was at 4.1 percent. (Table A)

In October 2024, two provinces in Central Visayas namely Bohol and Cebu recorded higher inflation rates for the bottom 30% income households relative to their respective inflation rates in September 2024. The highest inflation rate was recorded at the Province of Bohol at 6.0 percent while the lowest inflation rate was observed in the Province of Negros Oriental at 1.9 percent. (Table A)

C. Province of Siquijor

1. Overall Inflation

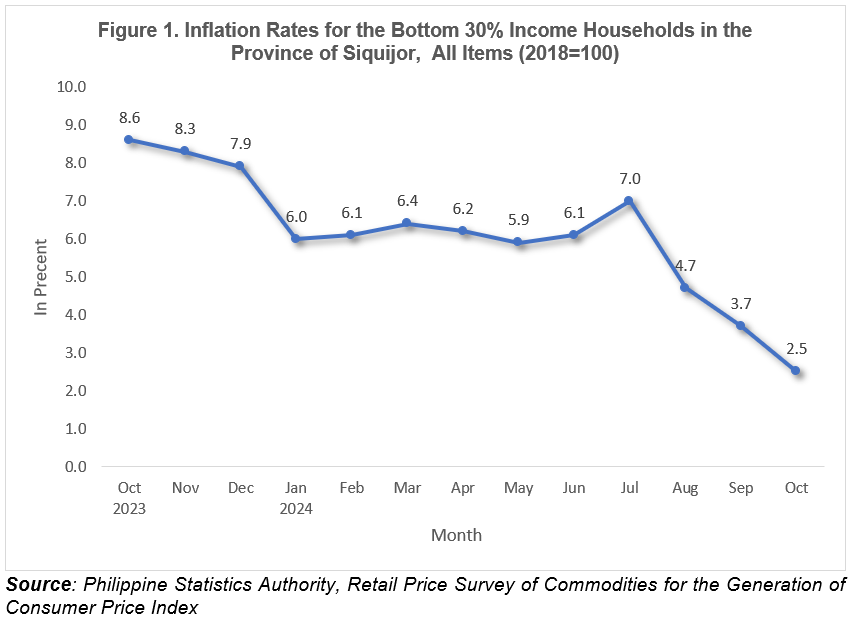

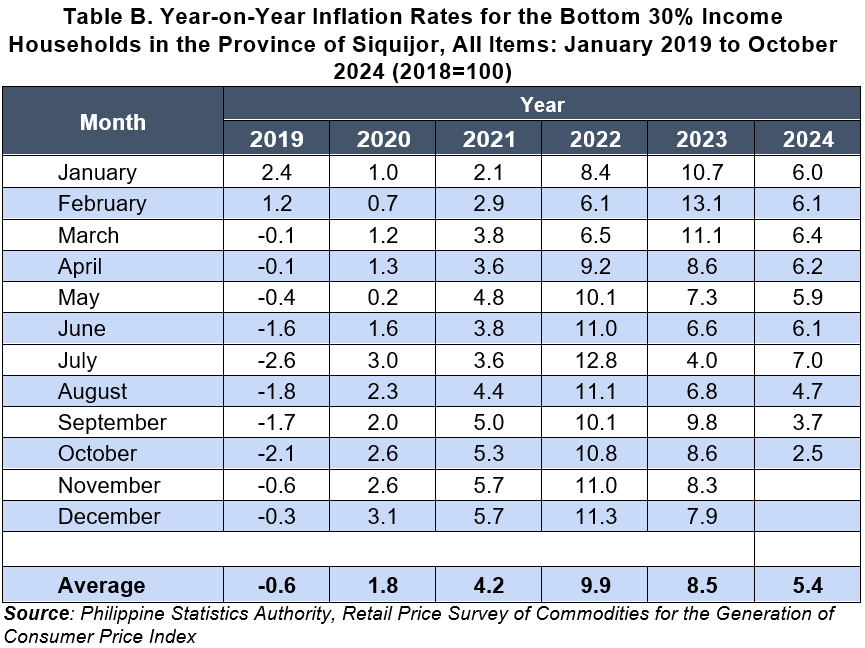

Unlike at the national and regional level, Province of Siquijor inflation rate for the bottom 30% income households decreased to 2.5 percent in October 2024 from 3.7 percent in September 2024. This brings the year-to-date inflation to 5.4 percent. In October 2023, inflation rate posted at 8.6 percent. (Table A & B and Figure 1)

1.1 Main Drivers to the Downward Trend of the Overall Inflation

The downward trend of the overall inflation for the bottom 30% income households in October 2024 was primarily brought by the slower annual decline of the heavily weighted Food and Non-alcoholic beverages at 4.0 percent from 5.8 percent in September 2024. Likewise, slower annual rate was noted to the index of housing, water, electricity, gas and other fuels at 2.2 percent from 2.9 percent in September 2024. Contributing also to the downtrend is the faster annual decline of transport at -6.6 percent in October 2024 from -6.2 percent in September 2024. (Table 3 & 4)

Additionally, the following commodity groups recorded lower annual rates compared to its previous month’s rate:

a. Personal care, and miscellaneous services, 4.6 percent from 5.0 percent;

b. Clothing and Footwear, 1.2 percent from 1.5 percent; and

c. Recreation, Sport and Culture, 2.7 percent from 3.0 percent. (Table 3 & 4)

In contrast, higher annual rate was noted to the index of health at 3.5 percent in October 2024 from 3.1 percent in September 2024.

Meanwhile, the indices of the following commodity groups retained their respective previous month’s annual rates:

a. Alcoholic beverages and tobacco, 2.6 percent;

b. Furnishings, household equipment and routine household maintenance, 1.5 percent;

c. Information and Communication, 0.6 percent;

d. Education services, 0.1 percent;

e. Restaurants and Accommodation Services, 1.3 percent; and

f. Financial services, -4.2 percent. (Table 3 and 4)

1.2 Main Contributors to the Headline Inflation

The top three main contributors to the October 2024 overall inflation for the bottom 30% income households in the province were the following:

a. Food and Non-alcoholic beverages with 95.2 percent share or 2.38 percentage points;

b. Personal care, and miscellaneous services with 8.8 percent share or 0.22 percentage point; and

c. Housing, water, electricity, gas and other fuels with 7.2 percent share or 0.18 percentage point.

2. Food Inflation

Food inflation for the bottom 30% income households at the provincial level that recorded a slower annual decline of 3.9 percent on October 2024 from 5.8 percent in September 2024. In October 2023, food inflation was at 12.3 percent. (Table 9)

2.1 Main Drivers to the Downward Trend of the Food Inflation

The deceleration of food inflation in the province in October 2024 was primarily brought by the decrease of the index of fish and other seafood at -3.5 percent from 2.3 percent in September 2024. Likewise, the decrease of index in vegetables, tubers, plantains, cooking bananas and pulses at -1.9 percent in October from 1.5 percent in September 2024 contributed to the downward trend. Also, slower annual decline was observed to the index of cereals and cereal products at 9.6 percent in October 2024 from 9.8 percent in September 2024. (Table 5 & 9)

In addition, lower inflation rates were noted during the month to the following food groups:

a. Ready-made food and other food products n.e.c, 10.4 percent from 12.9 percent;

b. Milk, other dairy products and eggs, 1.3 percent from 2.3 percent;

c. Meat and other parts of slaughtered land animals, -1.3 percent from -0.6 percent;

d. Corn, 15.6 percent from 22.6 percent; and

e. Flour, Bread and Other Bakery Products, Pasta Products, and Other Cereals, 1.8 percent from 2.3 percent. (Table 5 & 9)

Moreover, the following food groups posted higher inflation rates during the month compared to the previous month:

a. Rice, 7.2 percent from 2.7 percent;

b. Fruits and nuts, 14.9 percent from 14.2 percent; and

c. Sugar, confectionery and desserts, -5.4 percent from -8.2 percent. (Table 5 & 9)

Furthermore, the index of Oils and fats retained its previous month’s inflation rate at 0.2 percent. (Table 5 & 9)

2.2 Main Contributors to the Food Inflation

Food inflation contributed 88.5 percent or 2.21 percentage points to the October 2024 overall inflation for this particular income group.

Among the food groups, the main contributors for the food inflation during the month were the following:

a. Cereals and cereal products, which includes rice, corn, flour, bread and other bakery products, pasta products, and other cereals with 93.5 percent share or 3.65 percentage points;

b. Fruits and nuts with 18.8 percent share or 0.73 percentage points; and

c. Ready-made food and other food products n.e.c with 7.7 percent share or 0.30 percentage point.

TECHNICAL NOTES

Consumer Price Index (CPI)

The CPI is an indicator of the change in the average retail prices of a fixed basket of goods and services commonly purchased by households relative to a base year.

Bottom 30% Household

Families that belongs in the low-income bracket and the most vulnerable to economic and social difficulties. Based on the “relative poverty” concept, a household whose per capita income falls below the bottom 30% of the cumulative per capita distribution belongs to the low-income group.

One of the common characteristics of households in this income group is that expenditures on food items account for a more substantial proportion of expenditures compared to expenditures on other items. Price changes in food, therefore, would be expected to greatly affect this income group more than any other group.

Uses of CPI

• The CPI is most widely used in the calculation of the inflation rate and purchasing power of peso. It is a major statistical series used for economic analysis and as monitoring indicator of the government economic policy.

• Measures the composite change in the consumer prices in various commodities overtime.

Computation of CPI

The computation of CPI involves consideration of the following important points:

a. Base Period – The reference date or base period is the benchmark or reference date or period at which the index is taken as equal to 100.

b. Market Basket – A sample of the thousands of varieties of goods purchased for consumption and the services availed by the households in the country selected to represent the composite price behavior of all goods and services purchased by consumers.

c. Weighting System – The weighting pattern uses the expenditures on various consumer items purchased by households as a proportion to total expenditure.

d. Formula – The formula used in computing the CPI is the weighted arithmetic mean of price relatives, the Laspeyre’s formula with a fixed base year period (2018) weights.

e. Geographic Coverage – CPI values are computed at the national, regional, and provincial levels, and or selected cities.

Inflation Rate

The inflation rate is the annual rate of change, or the year-on-year change of CPI expressed in percent. Inflation is interpreted in terms of declining purchasing power of money.

Note: Statistical tables in excel file are provided as an attachment of this release.

Sgd.

JOSELITO C. MAGHANOY

(Supervising Statistical Specialist)

Officer-in-Charge