1. Philippines

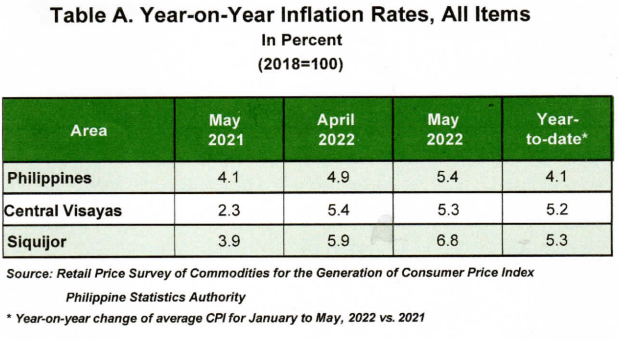

The Philippines’ inflation rate rose from 4.9 percent in April 2022 to 5.4 percent in May of 2022. This is the highest inflation recorded since December 2018. Inflation in May of previous year was lower at 4.1 percent. The average inflation for the first five months of the year stood at 4.1 percent. (see Table A)

May 2022 country’s inflation rate was primarily due to the higher annual growths in the food and non-alcoholic beverages index at 4.9 percent and transport index at 14.6 percent while inflation rates were lower for housing, water, electricity, gas and other fuels at 6.5 percent and furnishing, household equipment, and routine household maintenance at 2.5 percent. (see Press Release on CPI for All Income Households for May 2022)

2. Central Visayas

Central Visayas’ inflation rate, on the other hand, decreased from 5.4 percent in April of 2022 to 5.3 percent in May of 2022. May of previous year had a lower inflation rate at 2.3 percent. The first five months of the year 2022 recorded an average inflation rate of 5.2 percent. (see Table A)

3. Province of Siquijor

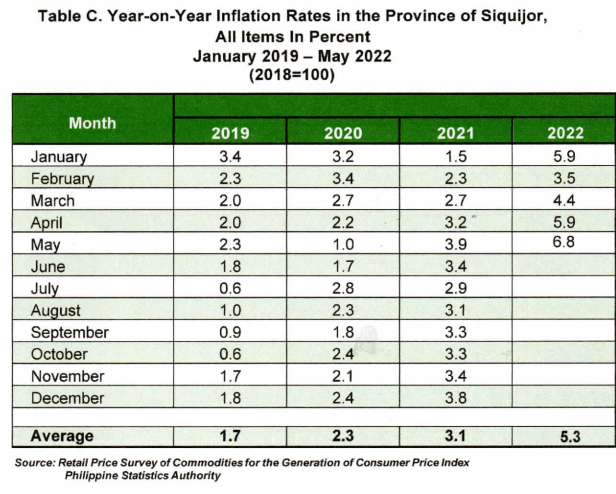

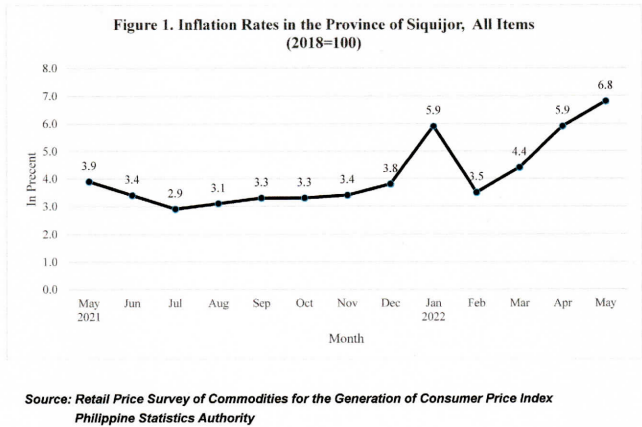

Meanwhile, the Province of Siquijor recorded an increase of 6.8 percent in May of 2022. This is the highest recorded inflation for the province since January of 2019. This was 0.9 percent higher in April 2022 with an inflation of 5.9 percent. The inflation in April of the prior year was at 3.9 percent. The province’s average inflation for the first five months of the year registered at 5.3 percent. (see Table A and C and Figure 1)

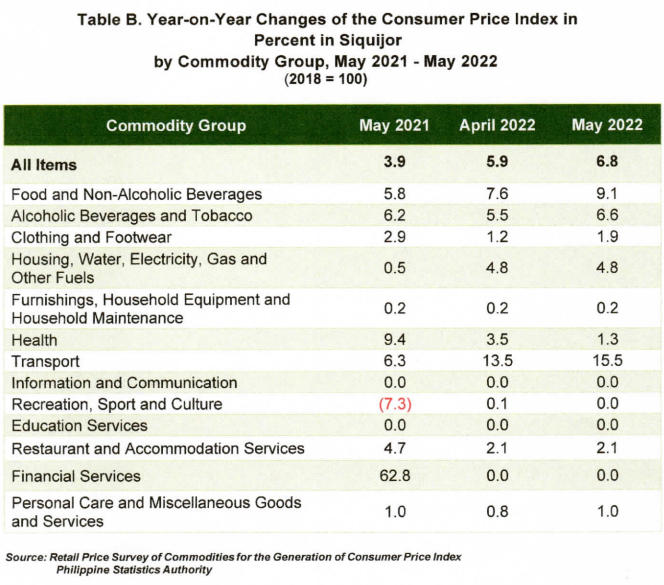

The higher inflation in the Province of Siquijor was mainly influenced by the higher inflation of food and non-alcoholic beverage at 9.1 percent, transport at 15.5 percent and clothing and footwear at 1.9 percent. (see Table B)

Moreover, higher inflation in the province were also observed in the following commodity group:

1. Alcohol Beverages and Tobacco at 6.6 percent; and

2. Personal Care and Miscellaneous Goods and Services at 1.0 percent.

Health and Recreation, Sport and Culture commodity group recorded a decrease at 1.3 percent and 0.0 percent, respectively, while the following commodities retained its last month’s record:

1. Housing, Water, Electricity, Gas and Other Fuels;

2. Furnishings, Household Equipment and Routine Household Maintenance;

3. Information and Communication;

4. Education Services;

5. Restaurants and Accommodation Services; and

6. Financial Services. (see Table B)

TECHNICAL NOTES

Uses of CPI

The CPI is most widely used in the calculation of the inflation rate and purchasing power of peso. It is a major statistical series used for economic analysis and as monitoring indicator of the government economic policy.

Computation of CPI

The computation of CPI involves consideration of the following important points:

Base Period – The reference date or base period is the benchmark or reference date or period at which the index is taken as equal to 100.

Market Basket – A sample of the thousands of varieties of goods purchased for consumption and the services availed by the households in the country selected to represent the composite price behavior of all goods and services purchased by consumers.

Weighting System – The weighting pattern uses the expenditures on various consumer items purchased by households as a proportion to total expenditure.

Formula – The formula used in computing the CPI is the weighted arithmetic mean of price relatives, the Laspeyre’s formula with a fixed base year period (2012) weights.

Geographic Coverage – CPI values are computed at the national, regional, and provincial levels, and or selected cities.

Inflation Rate is the rate of change of the CPI expressed in percent. See table C for the year on year inflation rate for all items.

Purchasing Power of Peso (PPP) is computed as the reciprocal of the CPI multiplied by 100. The PPP is inversely related to inflation rate. Thus, as the inflation rate increases from the base year, PPP declines.

(SDG.) AURELIA M. CANDA

Chief Statistical Specialist